People relocate for a number of reasons and sometimes those relocations mean you have to rethink your car budget.

Moving to a new city or country can be invigorating, but unexpected expenses can put a damper on your enthusiasm. The car market changes radically depending on where you go, so it’s important to do your research and acquire the tools to prepare for anything.

There is nothing more exciting than picking up and starting over in a new location. A change of scenery can be great for the soul. You will have new experiences and get the opportunity to reinvent yourself free of preconceived expectations.

However, a relocation can also be an extremely stressful time. In this article I’ll explore how you can plan for a car budget that works for you.

Don’t forget to factor your car budget into your moving expenses

In 2009, my wife and I relocated to the United States from Lima, Peru. Purchasing a car was my very first major expense.

The simple reality is that you need a car as a professional adult in the United States. My wife had lived her whole life in a city with adequate public transportation and she was stunned by how reliant Americans were on their personal vehicles.

Fortunately, I purchased a used car from my brother at a discounted price that was well below my car budget. At the time, I thought it was a prudent decision. As the relocation expenses continued to pile up, I soon realized my minimal car budget had saved me from a lot of headaches.

Avoid becoming financially overextended

It’s important to be prudent when you’re taking on a new experience. You’ll be overwhelmed by the things you need to learn and it’s easy to make mistakes.

Whether you’re relocating for work, or you simply want a change of scenery, the fun of the experience quickly wears off if you start running short of money.

In the United States, the car market has been extremely volatile over the last few years. This is due to a variety of factors including: COVID-19, inflation, supply chain issues, fuel prices, and various changes in employment.

These factors have resulted in an increase in pricing.

Over the first twelve months since the start of the pandemic, the new vehicle price index rose about 1 percent. More recently (i.e., between March 2021 and February 2022), this price index rose about 13 percent. This upward price pressure is manifested by strong demand and limiting supply factors

New vehicle sales and auto price inflation since the pandemic

Consider both new and used vehicles

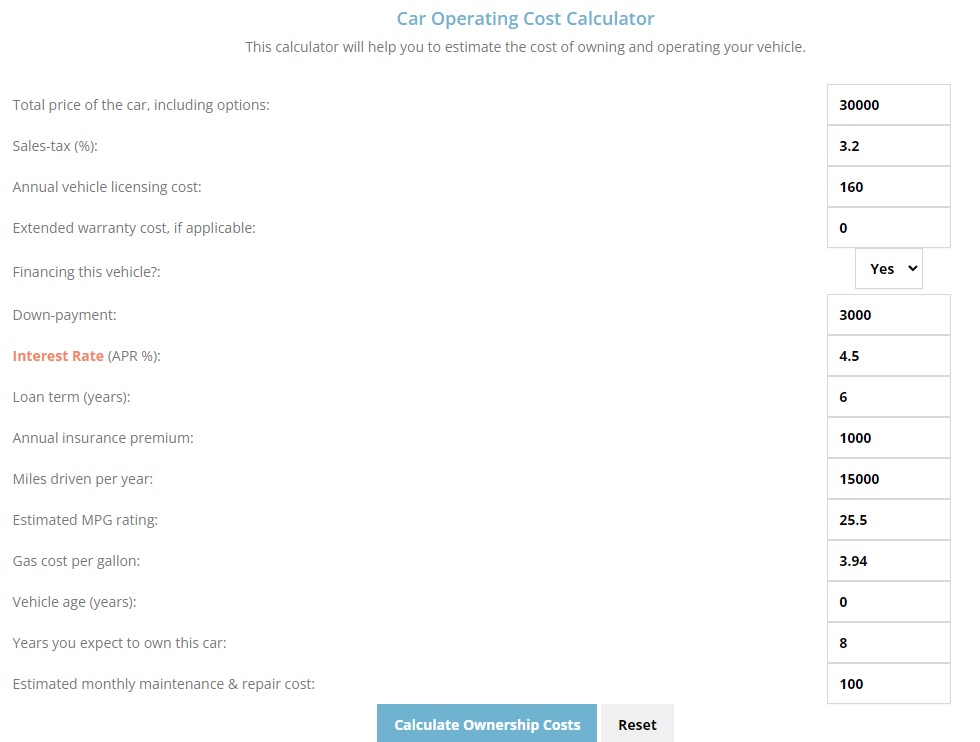

Before you purchase a new car, it’s important to run the numbers of your car budget with a variety of different variables.

There are always additional costs that come as a result of your vehicle choice. These costs include: insurance costs, gas expenses, repair work/warranty guarantees, and loan considerations.

Car budget calculators allow you to achieve a much clearer perspective of your financial outlook. It’s important to consider the effect fuel budget or different loan payment options can have on your overall quality of life.

Budget calculators can even alert you to expenses you might not have considered. Here’s an example:

Any time you make a major purchase it can become a stressful decision. Running the numbers is a great way to add clarity and make the perfect decision for your unique situation.

Be mindful of industry trends when planning your car budget

Every market situation is unique and it can change rapidly. The whole world is still recovering from the pandemic, and that recovery has led to fluctuations in car pricing.

The increasing cost of automobiles continues to be a major component of inflation, as many manufacturers face difficulties procuring chips that are a key component in cars and are therefore producing fewer new cars. While the chip shortage has caused new cars to grow more expensive, the price increase of used cars has been sharper. Data show that the CPI for used cars and trucks increased 40 percent since January 2021 while the CPI for new cars increased 12 percent

Ryan Kelly, Chris Kukla, and Ashwin Vasan

Remember that the lower price of a used car is balanced by the more imminent potential for repair expenses. At the same time, trends in pricing are not universal. It’s still possible to find a great deal either with a new or used car.

The best practice with a car budget, or any budget, is to allow yourself the flexibility to manage unexpected expenses.

Purchase a new or used car with confidence

It’s a wonderful feeling to take the wheel of a new vehicle and hit the road for the first time. There’s no greater sensation of freedom than to drive with the wind in your hair, free of worry.

Whether you’re planning a relocation, or you’re simply in need of a new vehicle, taking the time to evaluate your car budget is the best way to minimize your stress and maximize your freedom.

The uncertainty of an ever changing market is the only guarantee we have in life. It takes only a few moments to do the research, run the numbers, and find the best solution for your unique situation.