At last, Peru is a first-world country. I’d like to take a moment to congratulate Peru on its meteoric rise to the top of the world. It took a lot of blood, sweat, and tears. But here we are. Peru has made it! Taco Bell is here.

I say this because on the 17th of May, 2018, I ingested Taco Bell upon Peruvian soil. And it wasn’t imported this time. No sir. It was made fresh. We have a Taco Bell people! The future is bright.

Taco Bell Arrives to Jockey Plaza

When I first heard the rumors I maintained a healthy skepticism. I’d heard these rumblings before. Taco Bell was purported to be opening in the Estacion Central several years back. After scouting the area out, I saw no evidence. Little more than a red herring. But this time, there was proof. A café was torn down and walls were put up. Jockey Plaza hinted at something special. And then it happened.

Facebook made it official. Taco Bell spoke out. Dates were set and the excitement started to build. I attempted to skip work for the day but couldn’t work out a suitable excuse. Still, when the final bell of the day rang, I dashed for the mall. Naught could stand in my way. There would be feasting.

Three hours, three friends, and three soles

When I saw the holy temple I nearly collapsed in sheer astonishment. Here it was. My ocular nerves sent a beautiful neon white image to my brain. Those precious two words. Taco. Bell. When the euphoria faded, a new image came into view: A line. And not just any line, but a real massive serpentine queue. And another one. Yes, there were two lines. This would be no easy task.

I hadn’t eaten the entire day so as to maximize the deliciousness. My stomach rumbled hard enough to make a seismologist nervous. The first line fed into the second. We sat upon the floor and swapped stories of Taco Bell goodness. An army of loyal followers formed along the wall, blocking access to at least 5 stores. Hours passed as we waited to be shuffled into the second, smaller line.

90 minutes in, the pains grew intense. Weaker soldiers faltered and faded away, leaving the line behind. Reprieve came in the form of fries. Yes, Taco Bell here has fries. Zesty seasoned slices of Taco Bell taters. An employee strolled out with a tray and served us bags of these hot tots to keep us strong.

Three of my buddies showed up as I neared the end of the line. I was allowed to hold a spot for one, but the other two had to talk their way into the restaurant. Fortunately, they’re smooth as silk.

When security finally moved me into the second line it felt like victory was near. Before long I was standing in front of a Taco Bell register with someone waiting to take my order. In Peru.

Many great achievements were once deemed impossible. Beach bums doubted the Wright Brothers. Circumnavigating the globe seemed like suicide. Nobody thought Jesus could come back to life. And some, surely, never believed that Peru could make it this far. And yet here I was.

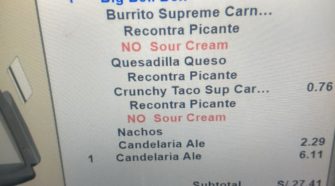

What I never considered was that Peru, in its infinite innovative madness, found a way to make Taco Bell better for just three soles. The cashier asked me if I wanted to change my soft drink for a craft beer for three soles. I’ve never had an easier decision in my life.

Nostalgia and history with every bite

As an expat, there’s certain things you just miss after a while. Taco Bell was one of those things for me. Other things include Butterfinger bars, A&W root beer, and the right to bear arms.

Being able to chow down on a Big Bell Box without boarding a flight to the USA ranks as one of the greatest advancements in Peruvian history for me. It’s greatly reduced the cost of entry to one of my favorite foods. Each time I sank my teeth into that quesadilla I tasted nostalgia and history with every bite. Taco Bell is where many an adventure began or ended, and May 17th was no exception.

Taco Bell gives me hope

Of course having a Taco Bell doesn’t magically erase the fact that Peru still struggles with corruption, rampant inequality, extreme poverty in its rural areas, and crime aplenty. We’ve still got a long ways to go.

Taco Bell used to be in Peru, back in 1996. Now, whoever thought it was a good idea to open a Taco Bell in 1996 in Peru was a moron. I hope that person got fired. But it wasn’t all his (or her I guess) fault. Peru just wasn’t ready. Not only were people dealing with far bigger problems than what meat to put in their tacos, but nationally wealth wasn’t strong enough to justify going to Taco Bell in the first place. While we see it as the cheapest fast food available, it’s still twice as much as your average Menu in Peru.

22 years have led to a great deal of progress. And Taco Bell is a sign of that progress. It’s proof that Peru has changed. It’s risen. That investors would be willing to sink millions of dollars into Peru to establish 10 Taco Bell locations in the next 3 years speaks volumes about this country’s advancement in recent times.

Taco Bell gives me hope. It makes me see the bright future ahead of Peru. And now, whenever I waver in my desire to remain in Peru, I think I’ll order another Big Bell Box with a craft beer and stick around for a while longer.